Shift Towards Outsourcing

The trend of outsourcing maintenance support services is gaining traction within the Banking Maintenance Support Service Market. Financial institutions are increasingly recognizing the benefits of outsourcing non-core functions to specialized service providers. This shift allows banks to focus on their primary operations while leveraging the expertise of third-party vendors to manage maintenance tasks. Data suggests that the outsourcing market in banking is projected to expand by 20% over the next few years, driven by the need for cost efficiency and access to advanced technologies. By outsourcing maintenance support, banks can achieve significant cost savings and improve service quality, which in turn enhances customer satisfaction. This trend is likely to continue shaping the Banking Maintenance Support Service Market as more institutions seek to optimize their operational frameworks.

Focus on Regulatory Compliance

Regulatory compliance remains a critical driver in the Banking Maintenance Support Service Market. Financial institutions are under increasing pressure to adhere to stringent regulations imposed by governing bodies. This necessitates the implementation of robust maintenance support services to ensure that all systems are compliant with the latest standards. Non-compliance can lead to severe penalties and reputational damage, prompting banks to invest heavily in maintenance services that can guarantee adherence to regulations. Recent statistics indicate that compliance-related expenditures in the banking sector have risen by approximately 15% annually. Consequently, the demand for specialized maintenance support services that can navigate the complexities of regulatory requirements is expected to grow, further propelling the Banking Maintenance Support Service Market.

Integration of Advanced Technologies

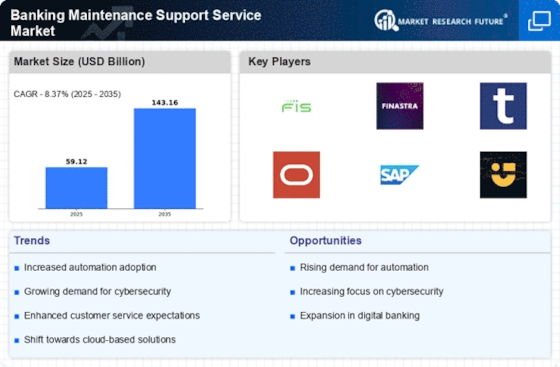

The Banking Maintenance Support Service Market is experiencing a notable shift towards the integration of advanced technologies. Innovations such as artificial intelligence, machine learning, and automation are being increasingly adopted to enhance operational efficiency. These technologies facilitate predictive maintenance, allowing banks to anticipate issues before they escalate, thereby reducing downtime and operational costs. According to recent data, the adoption of AI in banking maintenance is projected to grow at a compound annual growth rate of 25% over the next five years. This trend not only streamlines processes but also improves customer satisfaction by ensuring that services remain uninterrupted. As banks continue to invest in these technologies, the Banking Maintenance Support Service Market is likely to witness significant growth, driven by the demand for more efficient and reliable maintenance solutions.

Increased Focus on Customer Experience

Enhancing customer experience is a pivotal driver in the Banking Maintenance Support Service Market. Financial institutions are increasingly aware that seamless service delivery is crucial for customer retention and satisfaction. As a result, there is a growing emphasis on maintenance support services that ensure systems are operational and responsive. Recent surveys indicate that 70% of customers prioritize service reliability when choosing a banking provider. This trend compels banks to invest in maintenance solutions that minimize downtime and enhance service quality. By prioritizing customer experience through effective maintenance support, banks can differentiate themselves in a competitive market. This focus is likely to continue influencing the Banking Maintenance Support Service Market, as institutions strive to meet and exceed customer expectations.

Rising Demand for Cybersecurity Solutions

As cyber threats become increasingly sophisticated, the demand for cybersecurity solutions within the Banking Maintenance Support Service Market is on the rise. Financial institutions are prioritizing the protection of sensitive data and systems, necessitating robust maintenance support services that incorporate advanced security measures. The Banking Maintenance Support Service Market in banking is expected to grow at a rate of 18% annually, reflecting the urgency for banks to safeguard their operations. Maintenance support services that offer integrated cybersecurity solutions are becoming essential, as they help mitigate risks associated with data breaches and system vulnerabilities. This heightened focus on cybersecurity is likely to drive innovation and investment in the Banking Maintenance Support Service Market, as institutions seek to fortify their defenses against emerging threats.